A vast number of communities in Nigeria have no access to electricity supply, and even where they are linked to the national grid, power supply is unreliable and remains below economic relevance to SMEs and home consumers. What are solar energy mini-grids and how far can they go in meeting the energy and development needs of rural and suburban communities?

Over 45-55% of communities in Nigeria do not have access to the national electricity grid. These communities therefore lack access to electric power. This has affected micro, small and medium scale businesses in most of these rural, and sometimes peri-urban, communities. The agricultural potential lost to the lack of power is immense. For cassava alone, over 16 million tonnes (the equivalent of over 1 billion US dollars, together with several thousand possible value chain jobs) are wasted each year due to the absence of reliable electricity on-site.

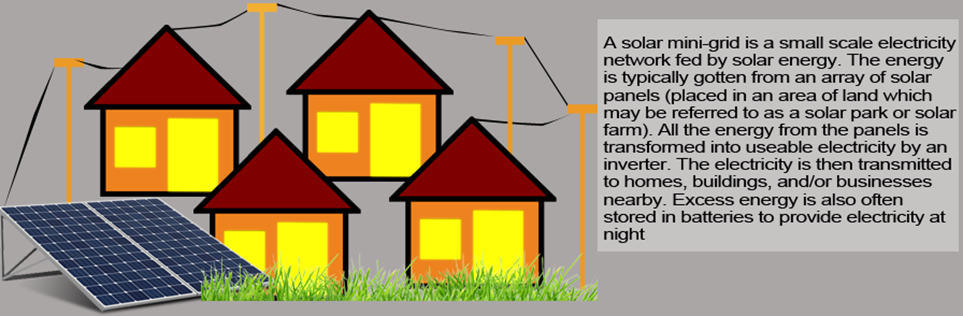

In order to bridge this gap, the potentials for investments in renewable energy mini-grids should be explored. Solar energy provides a platform for such renewable energy mini-grids. Biomass and wind are equally feasible electricity sources, as is natural gas.

These solar mini-grids, as a form of renewable energy, have huge potentials to meet the energy needs of hitherto unelectrified rural and suburban areas of Nigeria, particularly those areas with little or no hope of having access to the national grid in the coming years. This article explores a scenario of providing solar mini-grids to 24 rural communities, 6 in each geopolitical zone, and examines the socio-economic impacts within 12 months of installation.

The first major step would be to construct the solar farm by installing panels and the associated distribution cables. To construct a solar mini-grid of about 100kW, an investment of about $750,000 is required. To do so in 24 communities requires about US$ 18 million. The physical infrastructure can be operationalised in a matter of 3 to 4 months from break-ground. Consumers, i.e. homes and small businesses, are then charged either a fixed monthly tariffs or a rate per kWh consumed, depending on whether the power distribution systems are metered or unmetered. Based on business models already tested and proven by Nigerian developers, in communities with 500 to 1,000 or more people, the average annual revenues of such investment amounts to about US$ 180,000 or more per community installation (i.e. per mini-grid). In all 24 communities, total revenue of more than US$ 4,3 million accrues.

Going by an assumption that an average of one in five persons is running a micro- or small-scale business in these communities, at least 100 businesses would exist in each community engaging in farming, food vendoring, refrigeration of soft drinks, TV viewing centres and the like. With access to power, these businesses are expected to flourish by up to 40% of their business volume.

Access to power would result in increased efficiency of service delivery and petty production. Power would also allow for significant reductions in wastage (for example in rural engagements such as farming and farm produce processing which require proper storage). The power supply from the solar mini-grid would in fact stimulate growth in revenues through costs savings on such wastage and on fuels (for diesel gensets for example). Indeed, about 45% of savings are estimated for households, while about 55% are expected for MSMEs. With such significant cost savings and efficiency, business growth is envisaged, and these businesses could employ more hands as consumer demand for more servicing and/or production opens up in each business.

In addition to existing businesses, new businesses would also emerge. Allied services outfits or mini-production factories, for example block/brick making factories, can be expected to spring up owing to development and growth occurring. Transporters such as motorcyclists or tricyclists may also begin to ply routes leading into these communities, as rural farmholders, craftmakers and artisans – who can now produce more goods – commute daily or weekly to sell their products to nearby towns and cities. These are indirect jobs created by the growing local economy spurred by increased access to power through solar mini-grids.

From the experience of pioneer solar solution providers and entrepreneurs in the country, an average of two (2) additional jobs are created per small/micro business, resulting in about 200 new jobs per mini-grid installed community. In many cases, some of these workers may come from neighboring villages without access to such utilities. In addition, 360 temporary construction jobs could be created on each mini-grid installation site, about 160 agro-related jobs per site, and at least 20 indirect jobs, and a minimum of 20 service jobs per installation.

The beauty of the solar mini-grids lie in the short timescales within which they can be built and deployed, as well as the flexibility of bypassing the national grid and the latter’s inherent transmission shortcomings.

Mini-grids have their own characteristic challenges, such as the need for greater community involvement in planning and pricing of the grid. Mini-grids need stronger administrative controls to prevent collection losses and bypasses. And in order to make the investment a profitable one, electricity tariffs might lie slightly above the DisCo’s. Although this would still be beneficial and affordable for the consumers connected to the mini-grid, it does need engagement by the community in a way that is not common in the relationship between consumers and DisCos today.