Nigeria ranks as one of the world’s biggest gas flare countries; flaring hundreds of billion scf of natural gas each year, and losing billions of dollars’ worth of economic potential to gas flaring. Launched in late 2016, the National Gas Flare Commercialisation Programme seeks to reverse this trend by ending gas flaring by 2020. What actions are proposed by the Programme and what policy provisions are required to achieve the target?

Nigeria is one of the world’s largest emitters of flared gas. Flaring over 370 billion scf of gas in 2014 alone, Nigeria ranked fifth in the world in gas flaring, after Russia, Iran, Venezuela and Iraq, in that order. The same year, the volume of gas flared in the country was more than gas used for any single form of domestic consumption.

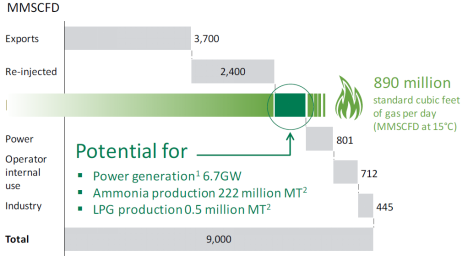

Nigeria gas utilisation in 2014. Source: DPR, NNPC, Expert interviews; Energy Blueprint Memo; and NLNG cited in: Gbite Adeniji (Dec. 2016)

Clearly, this volume of gas flaring is significant, and is capable of powering hundreds of thousands of Nigerian homes as well as industrial areas with electricity access yearly. Apart from these alternative socio-economic resourcefulness of otherwise flared gas, flaring has been proven to have serious consequences on environmental health and social impacts in local communities. These include respiratory illnesses, acid rains, corrosion of roofs, amongst others. These factors, namely, the alternative social-economic uses available for flared gas, alongside the need to curb negative environmental, social and economic impacts of gas flaring; have made a national strategy for gas flare commercialisation highly needful.

As part of the Federal Government’s Seven Big Wins – an array of 7 broad goals for optimising the Nigerian Oil and Gas sector – the Ministry of Petroleum Resources has clearly identified “zero gas flaring by 2020” as one of the specific targets under its Gas Revolution goals. To achieve this target the Ministry has designed a National Gas Flare Commercialisation Programme aimed at harnessing hitherto flared gas, and therefore ending gas flaring by the year 2020. Through the Programme, the government aims to deal with the challenges of processing associated gas, enhance more efficient supply and delivery of gas, and stimulate greater harnessing of gas to power.

Records show that since 2005, there has been about 70% drop in flare volumes nationally (NNPC Statistical Bulletin 2014; EIA Country Overview: Nigeria, 2015). This puts the current average annual gas flare reduction rate at 9%. At this rate, it might be said that it will be very difficult to achieve the FGN’s target of zero flaring by 2020. As such, the Gas Flare Commercialisation Programme creates and seeks to implement an action plan that will rapidly attract and accelerate investments into gas flare down projects.

Consultations, economic analysis and socio-economic benefits

At a workshop help in December 2016, the Ministry of Petroleum Resources (MPR) demonstrated that a wide range of industry stakeholders have been consulted in the process of drafting the Gas Flare Commercialisation Programme. These are said to have included both local and international players. Preliminary groundwork prior to launching the Programme also included diverse case studies and economic analysis of various flare gas utilisation options for the country.

Major highlights from the economic analysis include:

- harnessing gas from the top 50 flare points would reduce volume of flared gas by 80%, given 2015 gas flare locations and volumes as the baseline;

- over 130 flare points collectively flare about 1 billion scf of gas;

- majority of the gas flaring locations (about 65% of them) are onshore (i.e. on land);

- at least 80% of gas from the flaring locations can be viably utilised;

- although pipelines present the most viable option for transporting gas, compressed natural gas trucks would be preferred for security reasons;

- about 3 billion US Dollars’ worth of investments is required to achieve the gas flare commercialisation targets by 2020.

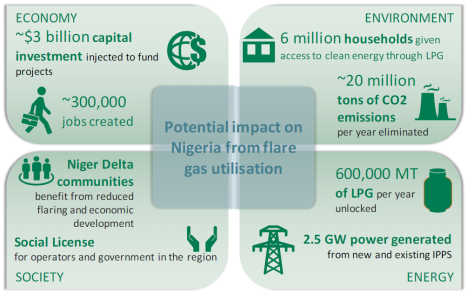

The analysis also shows that with these investments pumped in to implement the gas flare commercialisation programme, huge social and economic benefits would accrue to host communities in gas-rich regions, investors and the national economy as a whole. Benefits would include curbing pollution in local communities and providing households with clean energy, particularly LPG (cooking gas), employment and jobs creation, alleviating social unrest, increased MW of electric power generation potential through gas-to-power, amongst others.

Socio-economic benefits of the Gas Flare Commercialisation Programme (Source: Gbite Adeniji, National Gas Flare Commercialisation Program document, Dec. 2016)

The framework for achieving zero gas flaring by 2020

To mobilise funds and investments to implement flare down projects, the Gas Flare Commercialisation Programme is centred on a framework “ambitiously” designed to achieve zero gas flaring in Nigeria by 2020. This framework includes four components, namely:

- Fix the market and licensing process

- Improve access to finance and incentives

- Improve monitoring and enforcement

- Build the Federal Government’s capabilities and engage partners

Each of these framework components includes action plans and commitments to help facilitate the success of the programme.

Fix the market and licensing process:

Action plans to fix licensing include introducing open bidding processes and awarding licenses over multiple bid rounds. The licensing process is to be based on five principles, including, flexibility, fair pricing schemes, ensuring off-taker credibility, data accessibility on flare characteristics, and transparent licensing. Licensees (i.e. investors) will be screened for technical and financial capabilities before participating in commercial bid. Investors are to pay fixed licensing fees and handling fee (to operator) and an auctioning process will be structured around bidding where gas tariffs are variable.

Improve access to finance and incentives:

To improve access to the required 2 to 3 billion USD finance and incentives, planned commitments include openness to, and exploring, a broad range of funding instruments and options available from potential partners. These would include, but not limited to, concessional debts, risk sharing guarantees, foreign exchange instruments, vendor financing, grants, as well as technical assistance.

Improve monitoring and enforcement:

Proposed actions to ensure effective monitoring of the programme include data collection from operators. This will be used for subsequent tracking of flare down progress, audits by the Department of Petroleum Resources (DPR) and relevant agencies. In addition, flaring and venting targets will be strictly enforced to ensure close monitoring of the gas flare commercialisation strategy.

Build the Federal Government’s capabilities and engage partners:

A team across DPR and MPR has been constituted as of late 2016 to oversee the implementation of the gas flare commercialisation strategy. This team will centrally monitor and coordinate all Programme activities, manage external stakeholder interactions, make resources available to programme, investors, operators and other participants as appropriate and remove all roadblocks to the programme’s success.

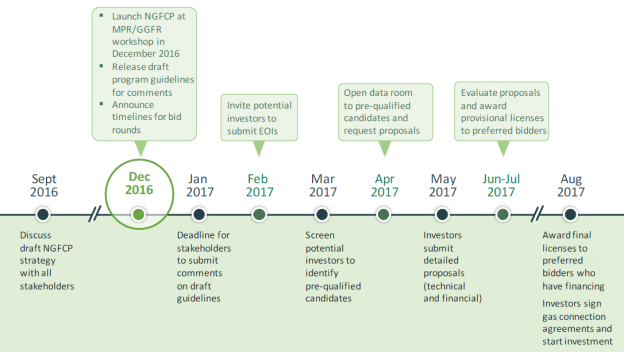

Timelines: Gas flaring commercialisation strategy

2017 Timeline for Nigeria’s Gas Flare Commercialisation Programme

Given its ambitious targets to end gas flaring in Nigeria by 2020, the Programme has gained the applause of several industry players, even receiving the World Bank Group’s support and sponsorship during its launch in December 2016. By all indications, the government, through the Ministry of Petroleum Resources, welcomes both local and foreign investors to show interest in the Programme.

However, major concerns regarding the Programme have included the highly condensed nature of the its timeline (see above). Some industry analysts have expressed concerns about the dates being unrealistic. Based on the timeline, it is expected that prospective home-based and foreign investors deemed competent would have been pre-qualified in March, and by now (May 2017), these pre-qualified investors should already be submitting their technical and financial proposals. However, it is currently unclear at what stage of the process the government is in: whether indeed investors have shown interest, and whether some pre-qualification has occurred. What is clear is that a number of local players have declared not having been put in the know about the process, which ought to have created a level playing field for all interested investors to apply.

If the gas flare-out and commercialisation targets are to see the light of day, the government will need to be more proactive – as well as more open and transparent – in taking the planned actions. In addition, closing existing policy gaps and presenting clear, concrete and appropriate regulatory frameworks is critical to the Programme’s success; which for example, is dependent on how soon the draft National Gas Policy is approved, gazetted and its critical elements, such as the Gas Infrastructural Blueprint, are implemented. Also, timely finalisation and approval of the accompanying Fiscals Policy which outlines financial incentives, commitments and frameworks for the gas industry is also very crucial in order to attract and secure investments in gas flare commercialisation. Finally, uncertainties regarding the Petroleum Industry Reform Bill would also need to be urgently resolved.

Links/attachments/downloads:

The Nigerian Gas Flare Commercialization Programme (PDF)

The Draft National Gas Policy (PDF)